Get your Management Price Per Unit

The number of residential units plays a part in our price quote but other factors are important too. We need to understand what association responsibilities are spelled out in the documents because every set of documents are different. Minimally we need to know what common elements are included, extent of maintenance required and the level of services expected by homeowners.

Understand your Standard Services

Sentry’s full service contract includes:

Get a tenured Community Manager

Sentry has been in the community management business since 1975. Managers average 8+ years in tenure, one of the most experienced workforces in the industry.

Know if you have any Formal or Informal Relationships with Vendors

Sentry Management is solely a community management firm. We have no affiliations or ownership positions with any other business or service that may be purchased by an association.

Know how much and what types of Insurance Coverage your firm carries

Sentry carries worker’s compensation, employee practices, property, vehicle, fraud/theft, liability policies, including $3 million bond and $10 million in umbrella coverage. Sentry is willing to share our certificate of insurance, so boards can make ‘apples-to-apples’ comparisons.

Make sure all Fees and Costs will be fully disclosed

You will never be surprised by an additional charge that is not revealed in the contract. Nothing is vaguely written or open-ended in our standard agreement.

Know how you handle the Administration of Financial and Accounting Matters

Sentry’s designation as an Accredited Management Organization® (AMO®) causes us to have separate, specialized accounting, collections and accounts payable functions. It guarantees transparency and the utmost integrity in handling your community’s funds.

Get a Proposal for Sentry Management Services

Simply provide us some basic information on this form, and someone will be contacting you to quickly gather the information to prepare a custom proposal.

Use the CommunityPro Portal as a Board Member

Using the Board Support portal is easy and intuitive. We provide a tutorial that will orient you to the software – click here to download the guide to use CommunityPro PORTAL as a board member.

Monthly financial reports are the lifeblood of association management.

Sentry makes sure they are easy to read, always accurate and accessible anytime through the “Board Room” – an online feature on each community website. Our reporting capabilities allow for any type of board member to find what they need.

Here are a few types of board members and how they benefit from our Board Room financial reporting:

You want all of the numbers, clearly and easily. With our Balance Sheet reporting, you can quickly find the amount of current assets (cash-on-hand), accounts receivable, prepaid assets (insurance premiums, termite bond purchases, etc.) property and equipment depreciation and deposits in escrow. The liabilities of accounts payable, prepaid assessments, restricted equity (reserves) and operating equity are also listed on the Balance Sheet, making it easy to ensure your association’s accounts are “in balance.”

If you’re the type that likes to periodically check your financial reporting and know quickly whether or not anything is amiss, the Balance Sheet and Cash Receipts Reports is for you. The Balance Sheet lists the association’s assets and liabilities by Chart of Accounts (COA), providing an “at-a- glance” statement of the association’s financial position. The Cash Receipts Report is like your association’s checkbook register. These two sources of information are relied upon by Board members who are most comfortable with “cash accounting”.

You don’t always delve deep into the financial reporting, but if a question comes up about whether a bill is paid or what vendors have received payment, you may want to use our Check Registrar report. The Check Register lists all checks written from the association’s checking account during the month by check number, payee, vendor number, date of check, and the amount of the check.

All monthly reports conform to Generally Accepted Accounting Principles (GAAP), which requires the use of the accrual basis of accounting. Though it may seem complicated at first, accrual basis accounting allows for you to ensure there are no unforeseen issues lying ahead.

The Balance Sheet lists your association’s assets and liabilities by COA, providing an overview of the association’s financial position. It provides the amount of current assets and liabilities of your association to ensure your accounts are balanced.

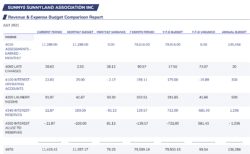

This report contains several pieces of information. The Current Period states the current month’s accrued and actual income and expenses, line-by-line, and compares it to the current month’s budget. The difference is reflected in dollar amounts. The Year-to-Date Period states the same information combined with the monthly totals for all previous months within the year. Lastly, it lists the current year’s annual budget line-by-line for overall comparison. The figures stated are a combination of actual and accrued amounts of income and expense.

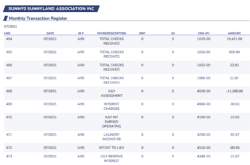

The Transaction Register lists the bookkeeper’s journal entries for the month, showing the actual accounts credited and debited. It reflects cash received by COA, Purchase Journal activities by COA, accrual reversals from previous months, current month accruals, checking account transfers, corrections and adjustments.

This report can be helpful in answering more difficult questions, such as what expenses make up the Estimated Accounts Payable figure for that month.

This report lists all checks written from the association’s checking account during the month. Note: Because the financial report is a combination of actual and accrued expenses, the total dollar figure for checks written will never match the total expenses for the month shown on the Revenue & Expense Budget Comparison Report.

The Closing Report lists the residential property sales of which the Closings Department has been notified during the month and the status of the closing. The report reflects the account number, the owner’s name and mailing address, the closing date and the data entry date.

The A/R Report lists past due and credit balances (shown as a negative number) by property owner account number and name. The report includes recent account status notes regarding closing or collection activity. A summary statement at the bottom of the report totals the amount of arrears (past due accounts) and prepays (credits).

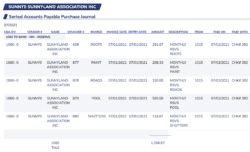

The Purchase Journal provides a line-by-line outline of expenses for the month, by category. It lists the COA, vendor number, vendor name, invoice number and date, amount and description. Again, because there are additional accrued expenses not yet paid, the totals on the Purchase Journal will not match the total expenses for the month shown on the Revenue & Expense Budget Comparison Report.

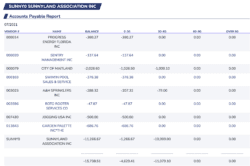

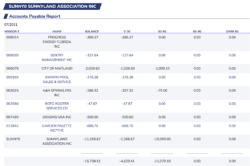

The A/P Report lists actual invoices received for payment but not yet paid. It does not include estimated accruals, which are reflected on the Balance Sheet as COA 2020 and are reflected on the Transaction Register as a journal entry.

The General Ledger Report is a summary that contains all the accounts for recording transactions relating to an association’s assets, liabilities, revenue and expenses. It works like a central repository for accounting data transferred from the other financial subsidiary ledgers.

CommunityPro® is an easy way to make payments, access association documents, view account history, stay informed and more.